Today on 16th January 2026, we are witnessing the abstraction of the paper market finally colliding with the irreducible reality of the physical element. We are witnessing a structural rejection of manipulated futures in favor of physical scarcity and industrial truth. The distortion across primary asset classes is reaching a resolution point.

I. The Silver Signal: Fracture In The Paper Empire

The Narrative: Silver prices dipped slightly today to $91.32/oz amid broader commodity pullbacks.

The Planck Scale Reality: This is the first true decoupling in precious metals history.

The Calculation: If the paper market fully fractures, silver reverts to its industrial floor of $91/oz as a minimum, with asymmetric upside to $300+ as the gold-silver ratio compresses. Expect institutional outflows from ETFs like SLV to accelerate as delivery demands outpace cash settlements.

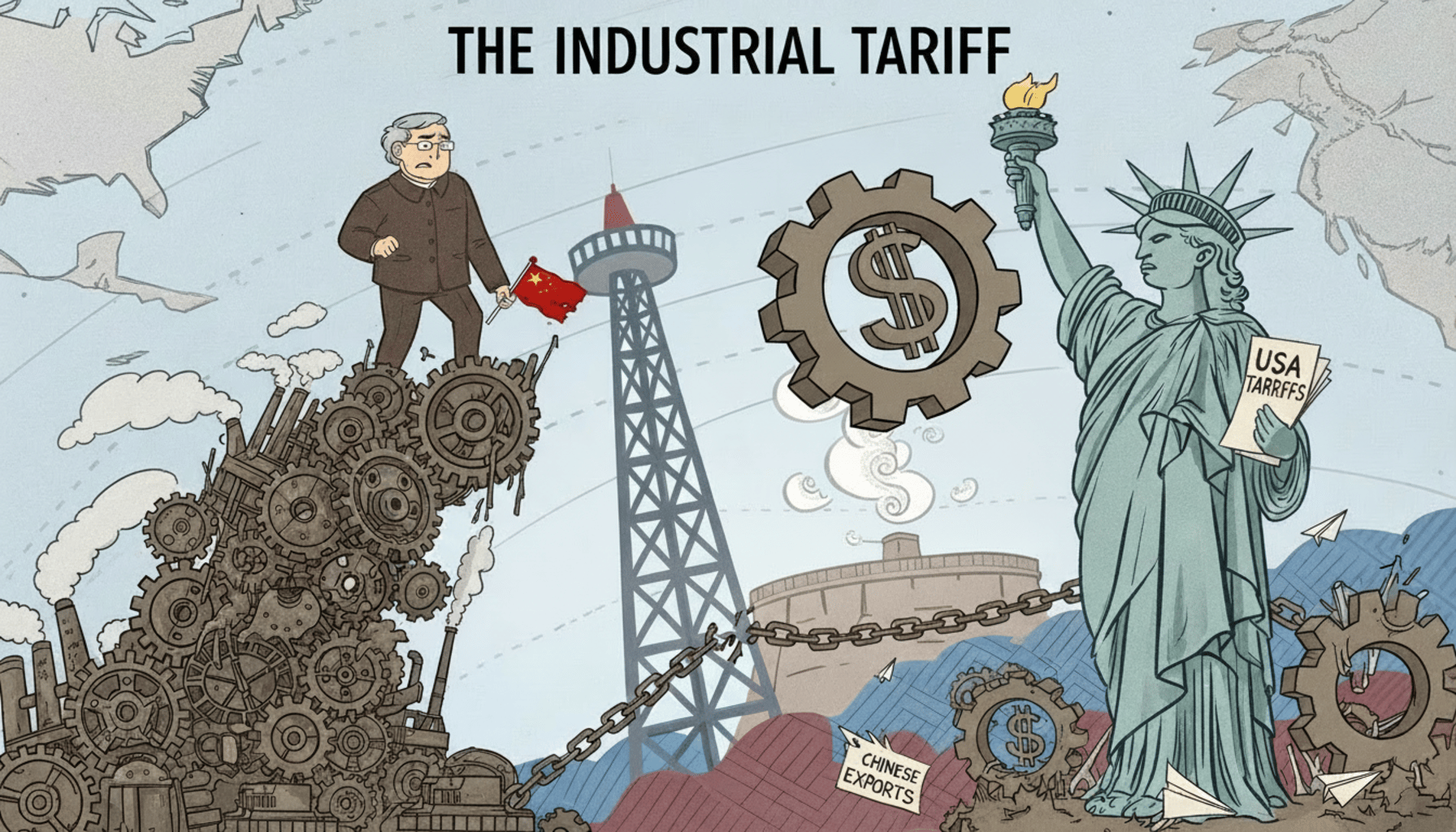

II. The Industrial Tariff: Asymmetric Demand

The Narrative: Global trade tensions and U.S. tariffs are pressuring supply chains. Market consensus suggests silver's rally is merely a byproduct of solar and EV sector growth.

The Planck Scale Reality: We are seeing a precision strike on the silver deficit, now totaling 820M oz since 2021 effectively erasing a full year of global mine supply.

Industrial Lock-in: 59% of demand is industrial (232M oz/year just for solar).

Supply Rigidity: 72% of silver is a mining byproduct, supply cannot "turn on" quickly regardless of price.

The Core Signal: BRICS nations (India/Russia) are treating silver as a reserve asset. The DXY is becoming a "variable" losing ground to hard elements.

The Calculation: At $135/oz, solar profitability faces a crisis point. Until then, we forecast a move to $100 driven by central bank pivots away from Treasuries.

III. The Central Bank Constant: Geography of Reserves

The Narrative: Central banks continue record gold purchases, but silver remains a secondary "speculative" play in the de-dollarization story.

The Planck Scale Reality: Hegemony is shifting from fiat flows to physical base elements.

The Inventory Collapse: COMEX inventories are down 70%.

The Strategic Shift: Silver’s addition to U.S. critical minerals lists and BRICS hoarding signals a hybrid reset where both metals (Gold and Silver) back new trade systems.

The Logic: This is no longer only about "real estate" in vaults. It's also about 1.5B oz annual demand vs. 1B oz annual supply.

IV. The Final Calculation: Positioning For The Distortion

THE JOURNAL: LIVE SIMULATED TRADES

Status: Executed on The Constant Terminal

Silver (Long): Entry $86 | Current $91.73 | STATUS: HOLDING. The goal is to see $100 Silver.

The Bottom Line: The state is currently attempting to seize the supply chains (China bans), the industrial demands (EV/solar surges), and the physical reserves (BRICS stockpiles) simultaneously. In this world, the only "Constant" is the decentralized code and the hard asset.

Disclaimer

This newsletter is published by The Planck Scale. All trades mentioned are Simulated Trades executed on The Constant Terminal for educational and simulation purposes. We are not financial advisors, we are observers of the Iterative Logic of the global markets. No real assets are at risk.

The baseline is the truth. Everything else is the distortion.